33+ home mortgage interest deduction

Itemizing only makes sense if your itemized deductions total more than the standard deduction. It allows taxpayers to deduct interest paid up to 750000 375000 for married filing.

Mortgage Interest Deduction How It Works In 2022 Wsj

Web If your mortgage was in place on December 14 2017 you can deduct interest on a debt of up to 1 million 500000 each if youre married and file separate.

. Ad Calculate Your Payment with 0 Down. Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and. 12950 for tax year 2022 Married taxpayers who file.

Single taxpayers and married taxpayers who file separate returns. For tax year 2022 those amounts are rising to. About 33 million for 2017 according to the latest IRS data.

A key reason for the change. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web Standard deduction rates are as follows.

Web The deduction for mortgage interest is available to taxpayers who choose to itemize. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

However higher limitations 1 million 500000 if married filing separately apply if you are deducting mortgage interest from indebtedness. Web Most homeowners can deduct all of their mortgage interest. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Homeowners who bought houses before. Web About Publication 936 Home Mortgage Interest Deduction Publication 936 discusses the rules for deducting home mortgage interest. Veterans Use This Powerful VA Loan Benefit for Your Next Home.

Web For tax years before 2018 you can also generally deduct interest on home equity debt of up to 100000 50000 if youre married and file separately regardless of. Compare offers from our partners side by side and find the perfect lender for you. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025.

If you are single or married and. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Web For 2019 about 13 million filers claimed the deduction vs. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web To take the mortgage interest deduction youll need to itemize.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Mortgage Interest Deduction Changes In 2018

Mortgage Interest Deduction Bankrate

Limitation On Home Mortgage Interest Deduction Tax Law Changes 2018 Youtube

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

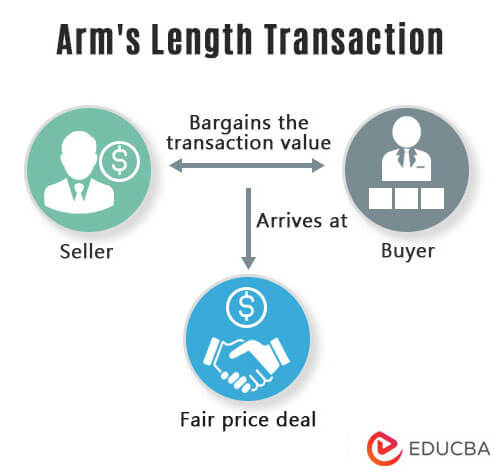

Arm S Length Transaction Characteristics Examples Transfer Pricing

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Mortgage Interest Deduction Bankrate

Limitation On Home Mortgage Interest Deduction Tax Law Changes 2018 Youtube

Valuation Of Mortgage Interest Deductibility Under Uncertainty An Option Pricing Approach Sciencedirect

Mortgage Interest Deduction Rules Limits For 2023

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Interest Deduction A Guide Rocket Mortgage

Mortgage Interest Deduction What You Need To Know Mortgage Professional

The Shame Of The Mortgage Interest Deduction The Atlantic

Betterment Resources Original Content By Financial Experts App

Mortgage Interest Deduction How It Works In 2022 Wsj

I 5 1 I 15x The Income Tax Act Ministry Of Justice