Paylocity paycheck calculator

Texas Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. How do I calculate taxes from paycheck.

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

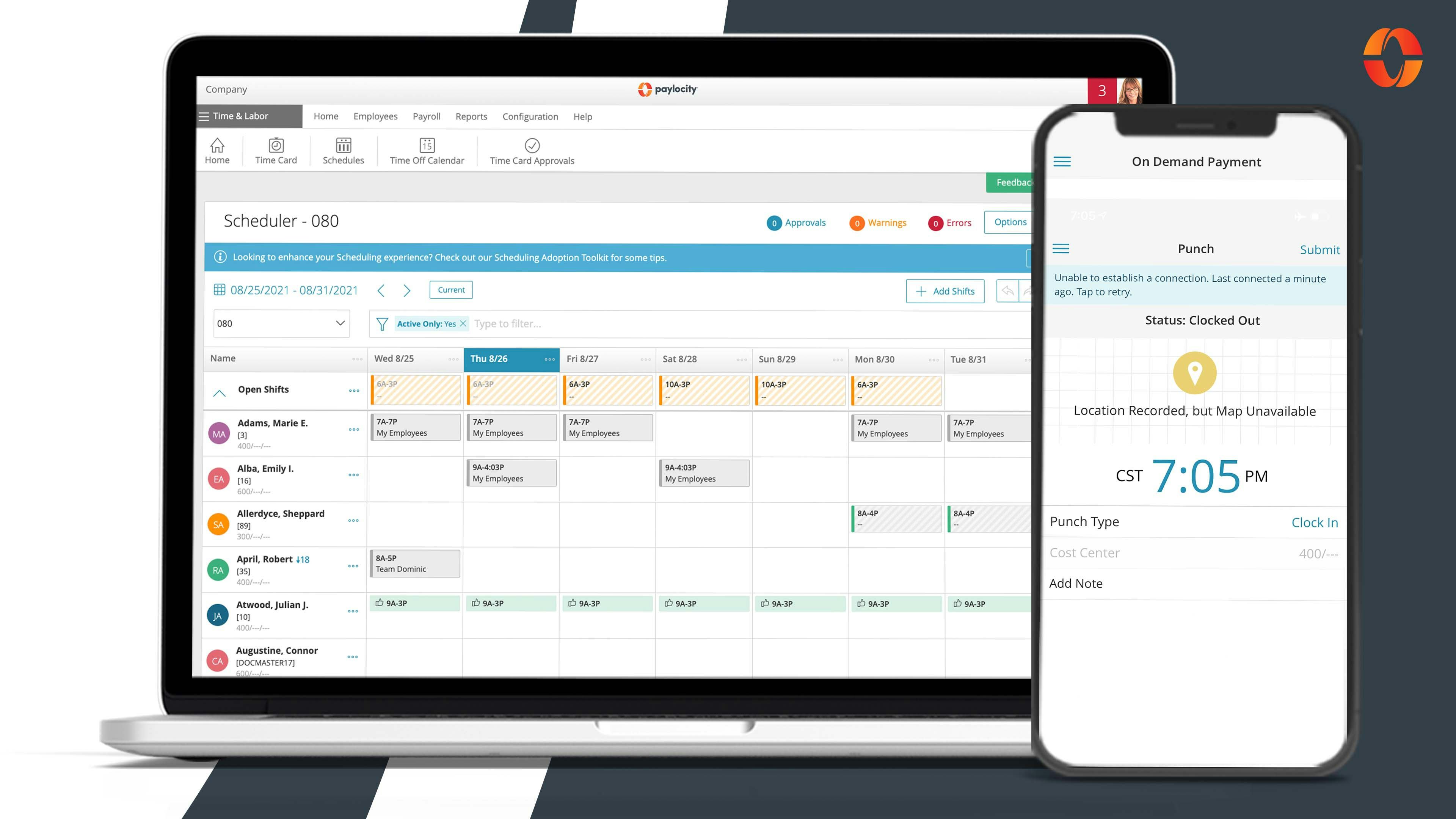

Paylocity Paylocity WebPay.

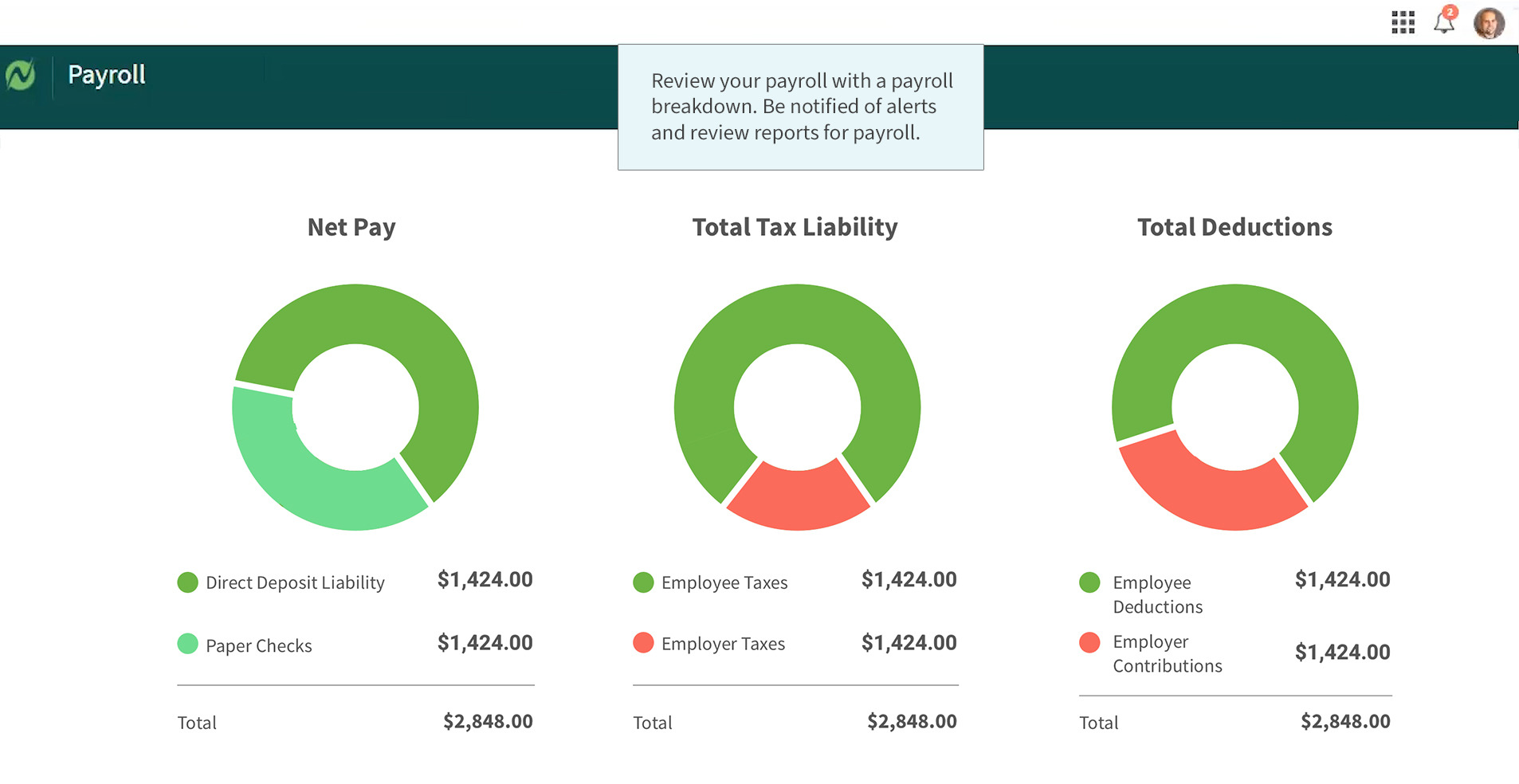

. Netchex offers a robust collection of financial calculators that are free and easy-to-use. Aug 29 2007. Read reviews on the premier Calculator Tools in the industry.

Ad Payroll So Easy You Can Set It Up Run It Yourself. For example if you earn 2000week your annual income is calculated by taking 2000 x 52 weeks for a total salary of 104000. Change state Check Date General Gross Pay Gross Pay Method.

Switch to Texas salary calculator. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. In a few easy steps you can create your own paystubs and have them sent to your email.

Switch to Illinois hourly calculator. To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year. Check the Remember My Username box to have the system populate the Company ID and Username.

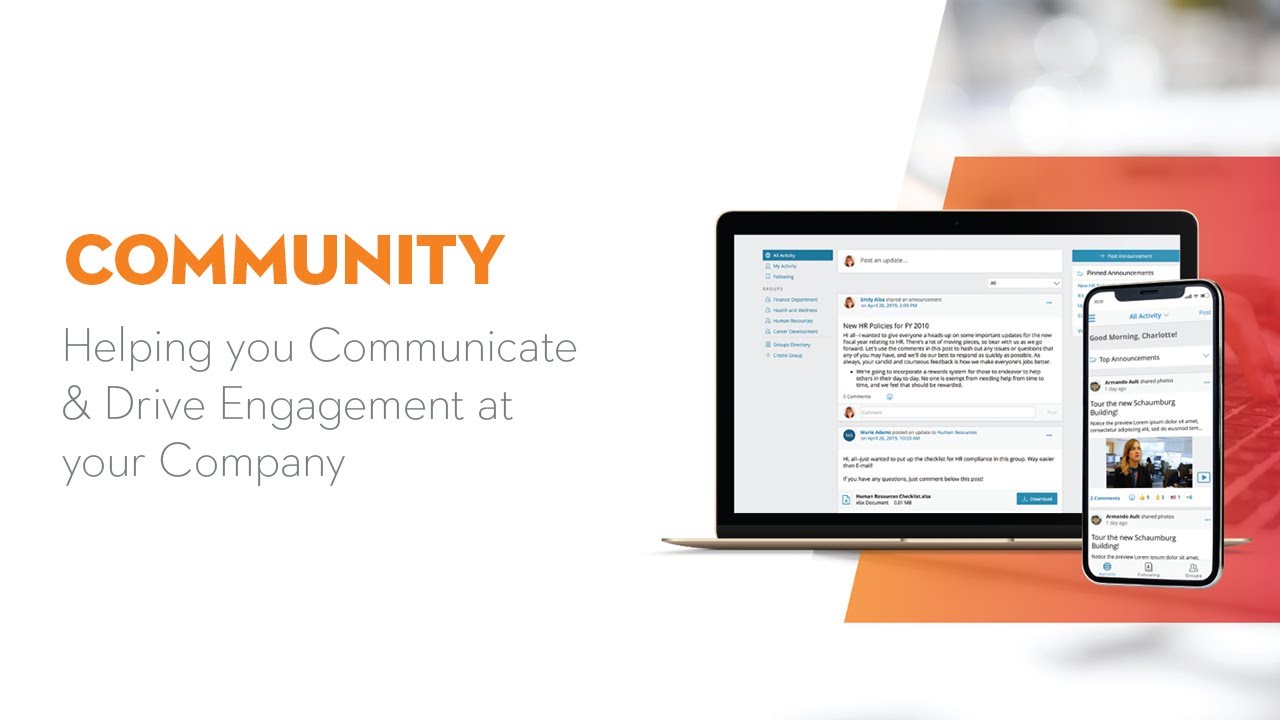

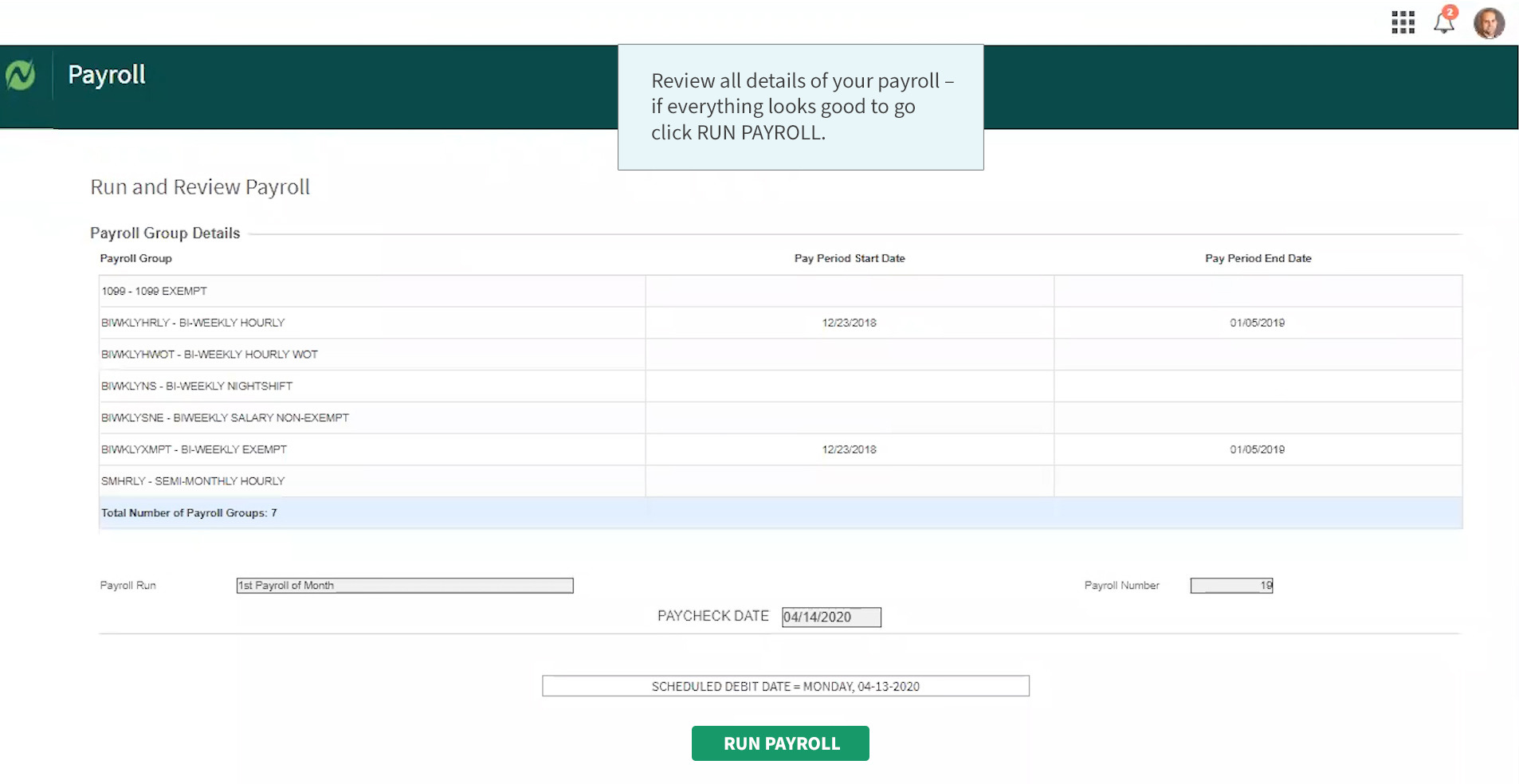

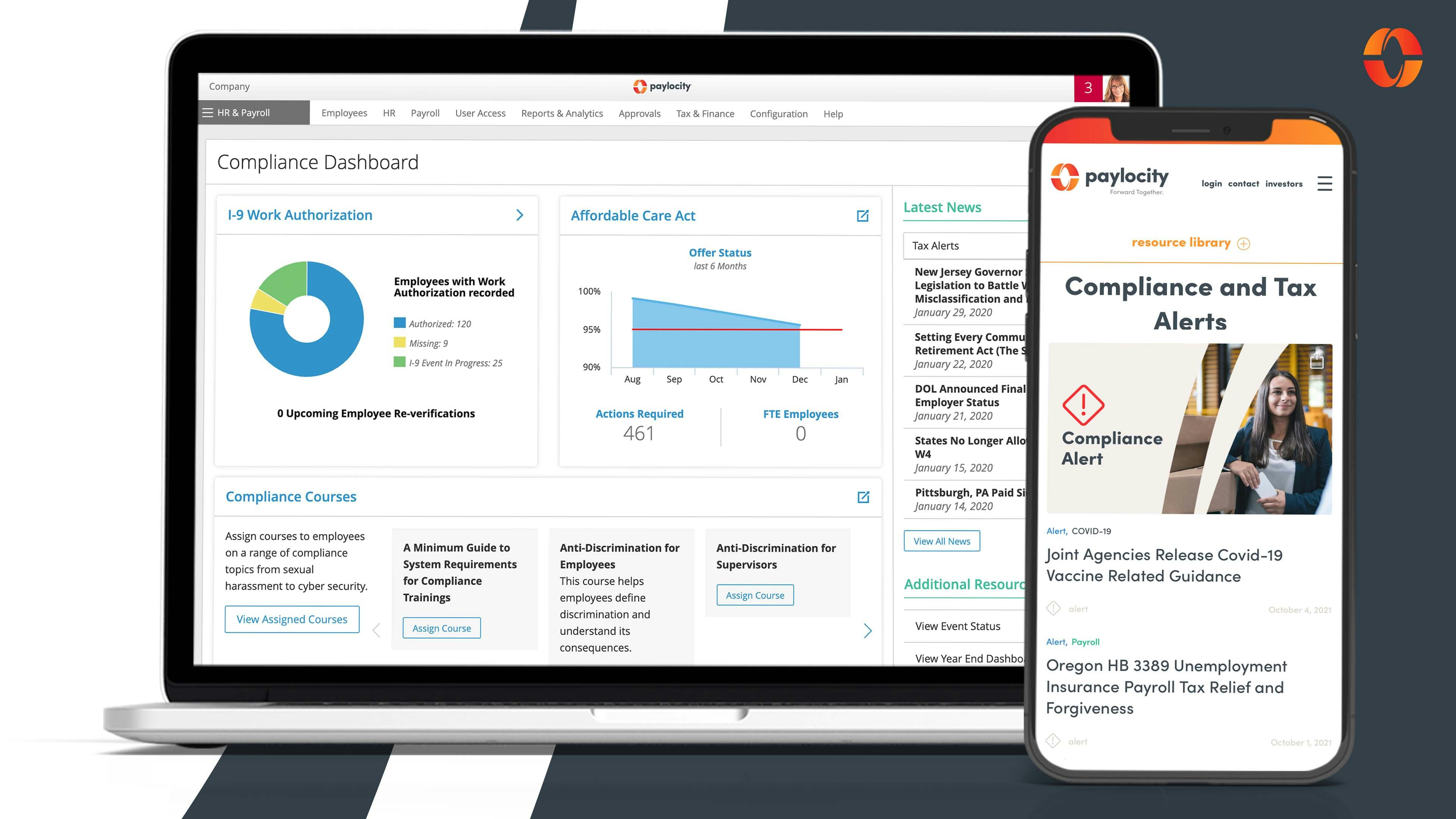

Payroll process is the process of compensating your employees for the work they perform. Use our employee payroll software to simplify payroll automate processes and stay tax compliant all in one spot. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs.

For example if an employee has a salary of 50000 and works 40 hours per week the hourly rate is 500002080 40 x 52 2404. And provide flexibility for staff to access a portion of their earned wages when they need it. Note this is must be set on each device by the individual.

One of the most useful and sought after this paycheck calculator quantifies take-home pay for salaried employees. State Date State Illinois. All Services Backed by Tax Guarantee.

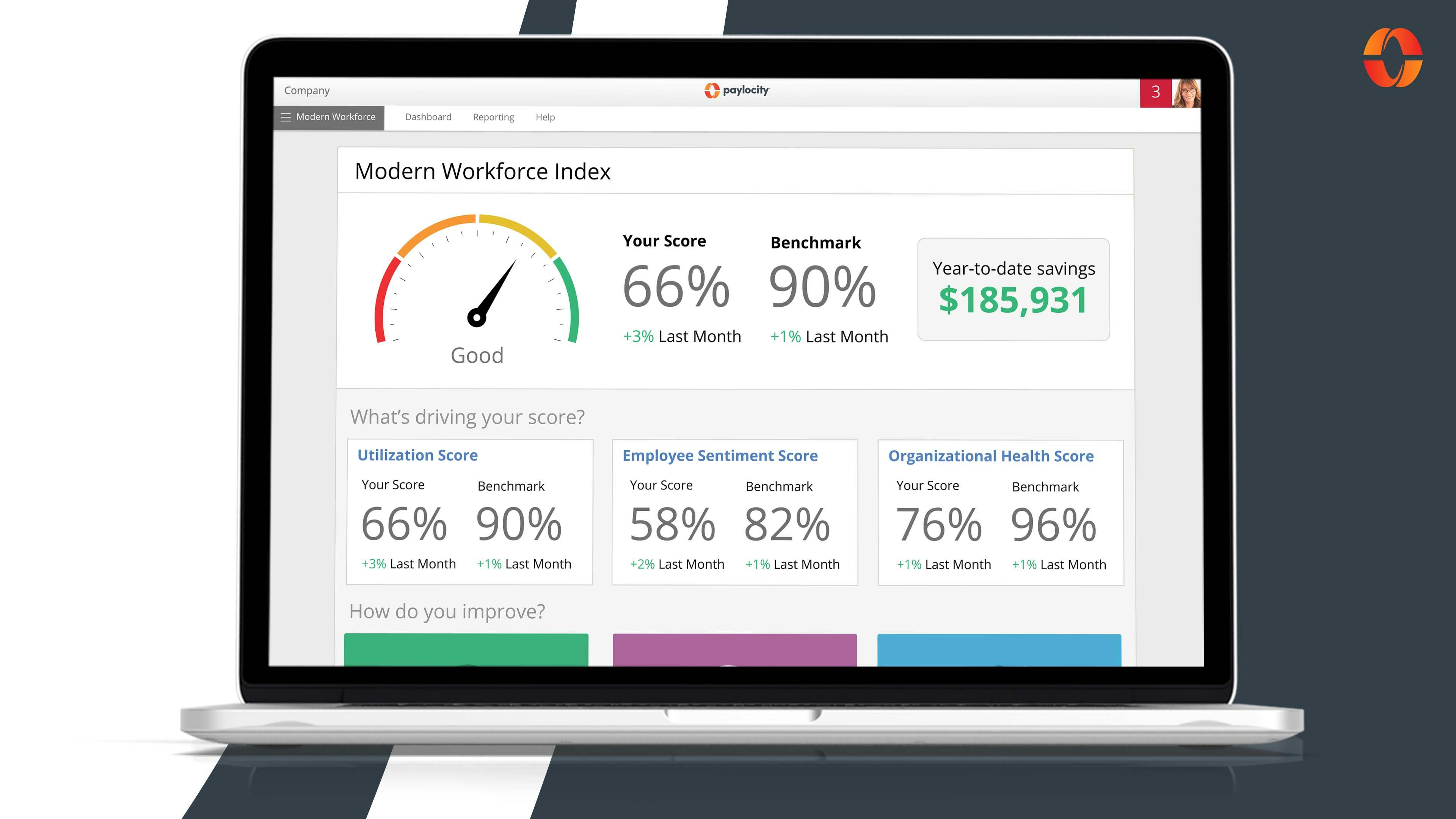

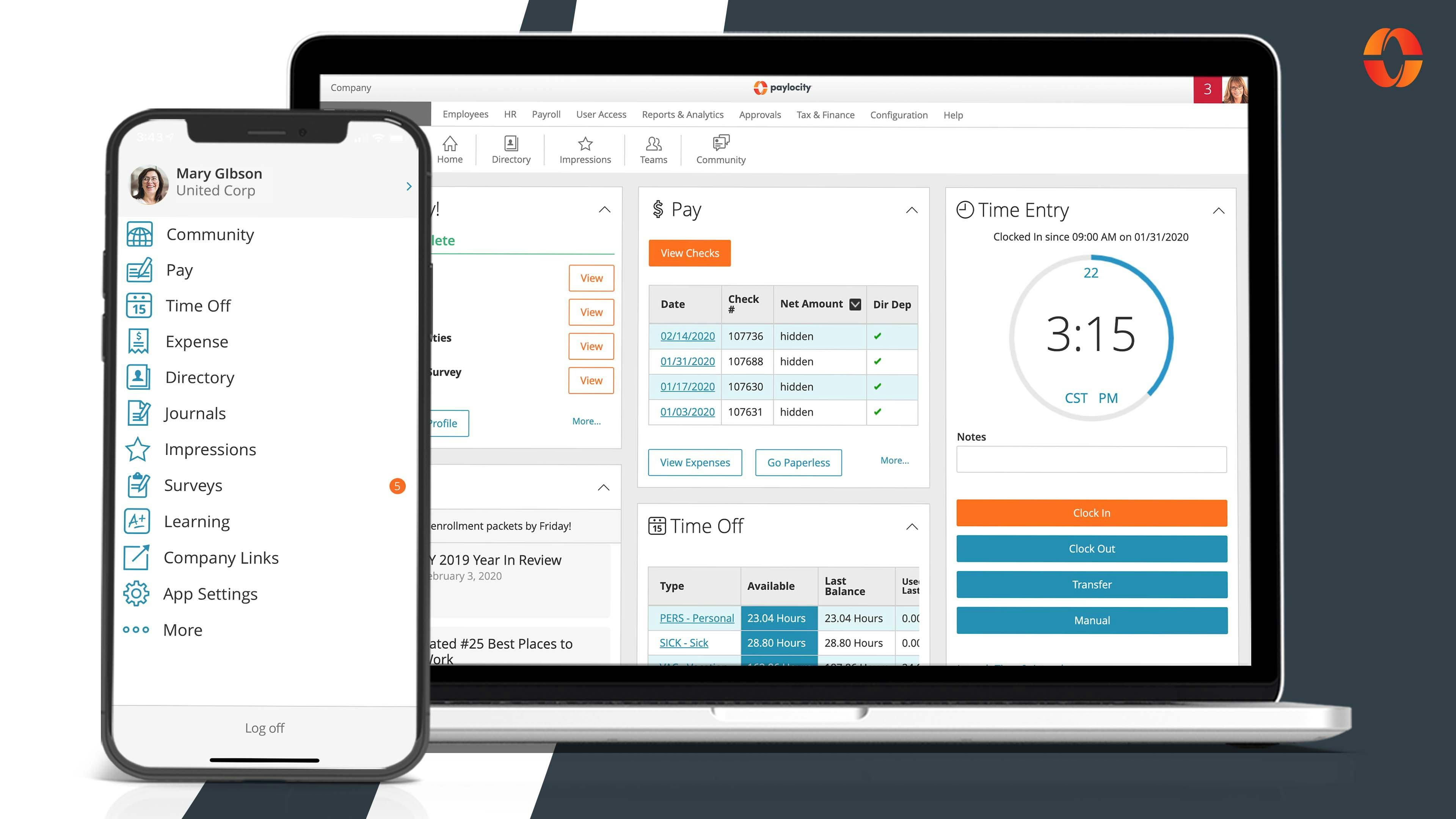

Use our Compensation Management tool to reward your employees while keeping your organizations bottom line top of mind. We use the most recent and accurate information. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck calculator.

Paylocity offers a web-based payroll and human resources system that is designed to be a nearly hands-off system for use by individual businesses while allowing supervision by the business public accountant. All calculators are automatically updated as payroll laws and tax tables change. Your pay frequency may differ such as if youre paid bi-weekly semi-monthly or monthly.

Ad GetApp helps more than 18 million businesses find the best software for their needs. Dont want to calculate this by hand. This includes the ability for accounting firms to access multiple client.

Simply enter your annual earning and hit Submit to see a full Salary after tax calculation for any State in the United States. Paylocity is the HR Payroll provider that frees you from the tasks of today so together we can spend more time focused on the promise of tomorrow. Payroll processing software automates these steps for small and large businesses.

Federal Gross-Up Calculator or Select a state Use this federal gross pay calculator to gross up wages based on net pay. We give you the compensation analysis and insights you need so you can pay your employees fairly and accurately. This Texas hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Enter the Paylocity assigned Company ID. From salaried and hourly paycheck calculators to 401 k and stock option planners run your business and help employees increase their financial awareness so they can plan. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Subtract any deductions and payroll taxes from the gross pay to get net pay. Next divide this number from the annual salary. Ad Create professional looking paystubs.

By accurately inputting federal withholdings allowances and any relevant exemptions consider this paycheck calculator a strong indicator of what your employees wages will be. It includes calculating their wages withholding taxes and employee benefits premiums and delivering payment usually through direct deposit. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be.

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. ICalculator provides the most comprehensive free online US salary calculator with detailed breakdown and analysis of your salary including breakdown into hourly daily weekly monthly and annual pay and tax rates. With our expert guidance on wage garnishment you can take the stress out of payroll garnishment compliance with complex legal requirements and put the focus back where it belongs on your business.

Fortunately Paylocitys Garnishment Managed Services can help provide relief. Allocate budgets that align with business goals and work with supervisors to make decisions together on pay. Your email and phone number.

Pull expense reimbursements into paychecks and run custom reports to get the data you need. Login Contact Client Support Partner Form Call to Request a Demo 8335080746 Request a Demo. No api key found.

This number is the gross pay per pay period. The PaycheckCity salary calculator will do the calculating for you. Salary and Hourly Calculators Salary Calculator Determine your take-home pay or net pay for salaried employees.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and other specialty payroll calculators for all your paycheck and payroll needs.

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Paylocity Elearning Industry

The Hourly Paycheck Calculator Netchex

Free Payroll Tax Paycheck Calculator Youtube

Paylocity Reviews Prices Ratings Getapp Canada 2022

2

Paylocity Reviews Prices Ratings Getapp Canada 2022

Paylocity Software Reviews Alternatives

Paylocity Reviews Prices Ratings Getapp Canada 2022

Paylocity Reviews Prices Ratings Getapp Canada 2022

The Hourly Paycheck Calculator Netchex

Paylocity Features G2

The Hourly Paycheck Calculator Netchex

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Paycheck Excel Good Essay

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

Paylocity In 2022 Reviews Features Pricing Comparison Pat Research B2b Reviews Buying Guides Best Practices

Free Payroll Software 2022 Affordable Cheap Solutions